Did you know 47 percent of retail businesses fail within the first four years?

Are you a CEO or Owner of the company wondering what’s wrong with your business? It may be because you’re looking at your bank statement [cash flow] instead of your books.

Why you keep almost running out of cash? Or maybe you want to learn which numbers you should really be looking at instead of just keeping your bank balance on the computer screen every day.

Either way, by the end of our lesson here on cashflow management vs REAL numbers, you’ll know what to do next.

Well, avoiding understanding your financials and only focusing on the cash flow is a classic mistake most business owners make. So you’re not alone.

But many of those cash flow focused owners are slowly going broke because they’re not looking at the full picture.

Why Business Owners Focus on Cash Flow

One true reason why most business owners avoid looking at the numbers is that numbers paint an accurate picture of what is actually happening in your company. The numbers never lie, and they give you a reality check on the actual financial health and standing of your business.

For some reason, we believe that avoiding the truth for too long will somehow make the problem dissipate in the air. When in reality, it does precisely the opposite, i.e., things get out of hand, and we have to face our first financial nightmares.

Unfortunately, many small business CEOs and business owners do not review their financials at all. And here’s why:

- Not knowing how to read a financial income statement

- They do not trust the accuracy of their finances

- Working without knowing how financial information can help them make informed business decisions

Why are the Financials Important

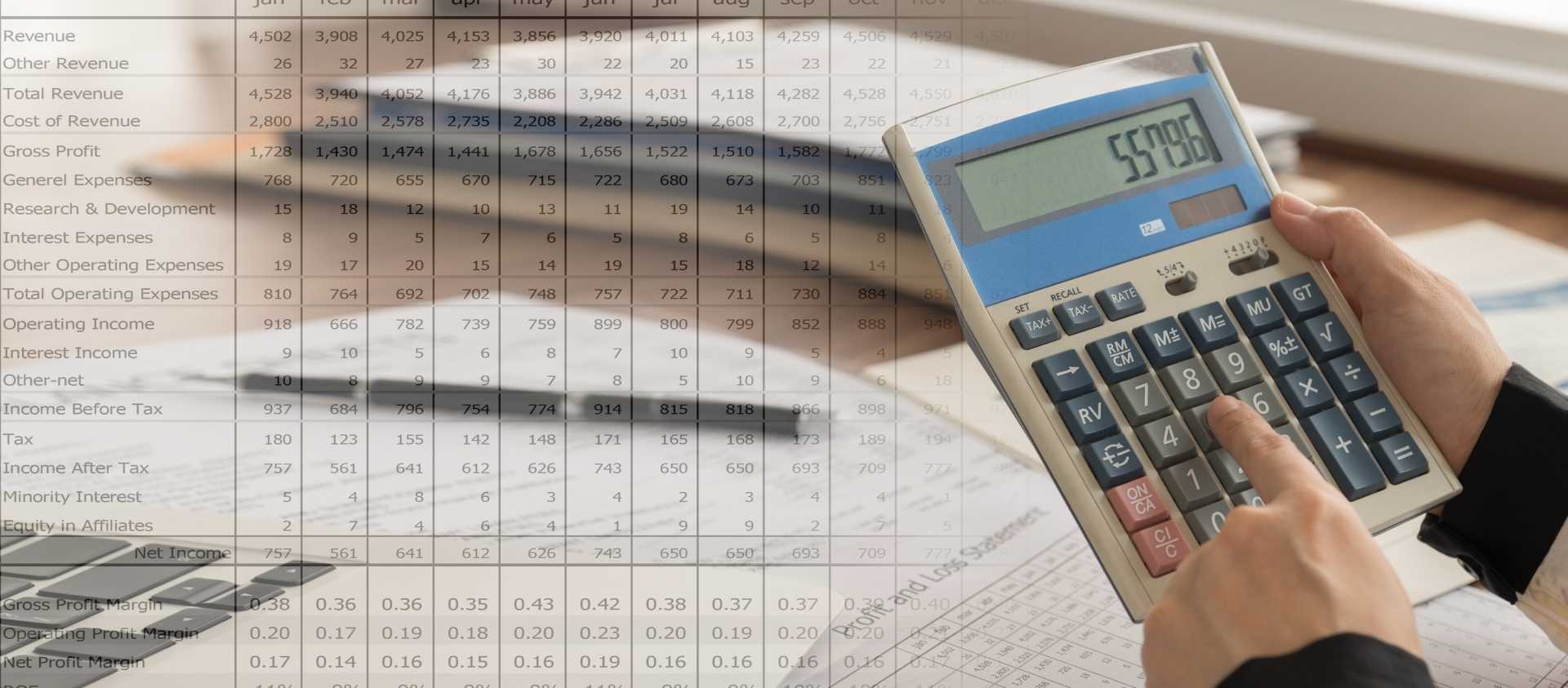

Business financial numbers will give you a clear insight into where your company has been, where it stands, and where it is heading. The numbers allow you to make educated and well-informed decisions for future business endeavors.

Because those numbers let you forecast future sales or predict which products are going to perform well. That’s if you understand them. Your bank balance won’t do that.

You can also use the numbers to determine if you need to move to new sales channels or hire new employees.

Did you know 47 percent of retail businesses fail within the first four years for several reasons?

And lack of understanding of their numbers has a huge role to play in all those reasons. These include

- Emotional pricing

- Inadequate planning due to no knowledge about the finances

- No prior experience in record keeping and/or paying their taxes etc.

Another study suggests 97 percent of e-commerce companies fail due to the same reason i.e. lack of knowing about business’ finances.

So other than the gut feelings, do you know how YOUR company is performing in terms of numbers? Other than monitoring the balance in the checking account?

There are several questions you can ask in order to determine the current financial condition of your business.

Questions to Ask Yourself to Know Your Numbers

Business is undoubtedly a numbers game. It is essential for you to know them for clear visibility and focus on what is going on the ground.

Are your financial figures up to date?

Your financial figures can help identify several critical aspects that need your attention.

They will inform you whether your inventory is sufficient for the upcoming sales season or is your costing under control.

The numbers give you real-time information about how financially successful your company is at any given moment of time.

Not knowing your business is like running your business in hunches and worse-case blindly.

It’s like deciding to drive your car in the dark with no lights…driving based on your intuition. Or trying to get to a destination by making sure you have enough gas, but never consulting a map.

How to Gain Clarity and Visibility on Your Business

Think about those 2 words: “visibility” and “clarity”. Imagine that you could apply them to your business finances.

Imagine you had a clear picture of how your business was doing at all times – good or bad.

Feels good, doesn’t it?

If you want that feeling, you have to know that the numbers are up to date. Here are some examples of how knowing your numbers will help you gain a clear business perspective.

Sales & Profits

You'll KNOW if Revenues (Sales) are enough to meeting your profit goals.And from that what the real Profit % is, not just what ends up in the bank at the end of the month.

Are your Costs In-Line

Are you paying too much in variable costs? Are rising supply or materials costs rising or falling over time?In other words, it could be months before big spikes in our COGS shows up in your cashflow accounts look.

Overhead and Business Expenses

Watching your operational expenses on a monthly basis can save you thousands and thousands of dollars.. and some nasty surprises.

Most importantly, the numbers will help you understand the overall profitability of your company. This will be your ultimate indicator of how successfully your business is.

Other Benefits of Knowing Your Numbers

Some other benefits include:

- The numbers can help determine where your company is leaking money

- Identify which of your products or services bring in more sales or generating or revenues. -

- You can actually do forecasting and planning

- You can increase profits without making additional sales by makings adjustments such as reduction in variable costs

The Takeaway

Don’t be afraid of the numbers. And don’t take the easy way out of relying on your checking account to gauge the health of your company.

Your checking account is lying to you.

Your real numbers are telling you the truth (hopefully that you are doing great!).

Think of these numbers as the pulse of your company. Any fluctuation in the pulse rate will give you a real-time warning that something is not right. This way, you will be able to act quickly and correct the course of action and get back on track.

The good news here is that knowing business numbers doesn’t require you to be a genius. Or a math wiz.

All you need is to understand how to read an income and other financial statements.

You can learn that on your own – or partner with someone like DTu Accounting to help you get started.